|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Refinance Facility: A Complete Beginner’s GuideThe concept of a refinance facility is often encountered by homeowners and borrowers looking to improve their financial situation. In essence, refinancing involves replacing an existing loan with a new one under different terms, which can lead to lower interest rates, reduced monthly payments, or altered loan duration. What is a Refinance Facility?A refinance facility is a financial option that allows borrowers to modify the terms of their existing loans. It is commonly used for mortgages but can apply to other types of loans as well. By refinancing, borrowers can potentially reduce their financial burden or adjust their loan terms to better suit their current circumstances. Types of Refinance Facilities

Benefits of RefinancingRefinancing can offer several advantages:

For those considering refinancing a mortgage, exploring options like a 30 year fixed mortgage can provide more predictable monthly payments. When to Consider RefinancingRefinancing might be beneficial under certain conditions:

It's essential to evaluate your financial goals and the costs associated with refinancing, such as closing costs, before making a decision. Steps to Refinance a Loan

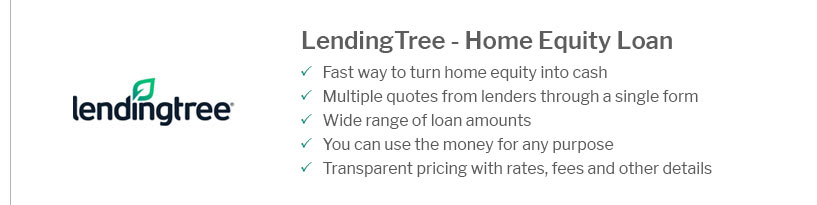

Homeowners can also consider the option to take out a loan against their house to leverage their home's equity for various financial needs. Frequently Asked QuestionsWhat costs are involved in refinancing?Refinancing usually involves costs such as appraisal fees, closing costs, and possibly early repayment charges. It's crucial to weigh these costs against potential savings. How does refinancing affect my credit score?Applying for refinancing may cause a temporary dip in your credit score due to the hard inquiry, but the long-term effects can be positive if it leads to better loan terms. Can I refinance with bad credit?It is possible, but options may be limited and interest rates might be higher. Improving your credit score can help secure better refinancing terms. Is there a limit to how often I can refinance?While there's no legal limit, frequent refinancing can lead to high costs and possible negative impacts on your credit score. It is advisable to refinance only when it provides significant benefits. https://unacademy.com/content/bank-exam/study-material/general-awareness/importance-of-refinance-facility-in-monetary-policy/

The refinance facilities are intricately linked with the monetary policies as refinancing refers to repaying the previous loan amount by changing the terms. https://www.youtube.com/watch?v=77r54zQ6udU

Refinancing refers to the process of paying out your current home loan by taking out a new loan, either with your existing lender or through ... https://uk.practicallaw.thomsonreuters.com/6-521-1773?transitionType=Default&contextData=(sc.Default)

The advantage to the borrower of having a refinancing facility is that it can refinance the loans with debt that is outside ...

|

|---|